North Bay Commercial Market – end of Q2 2025 Trending Report

-

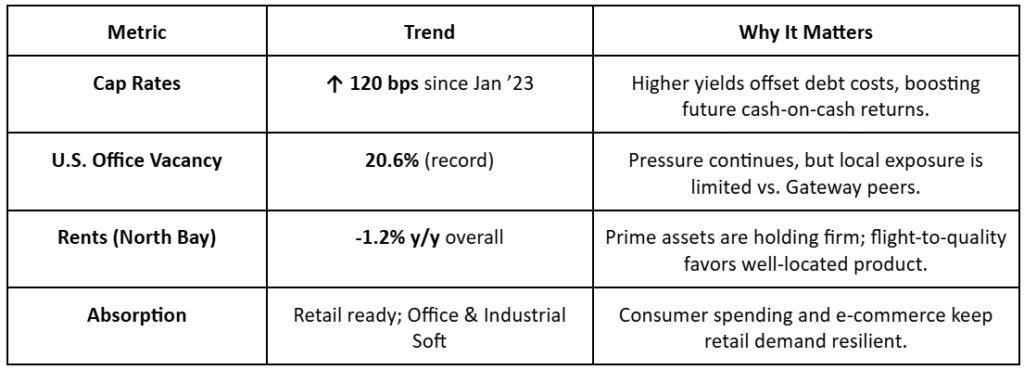

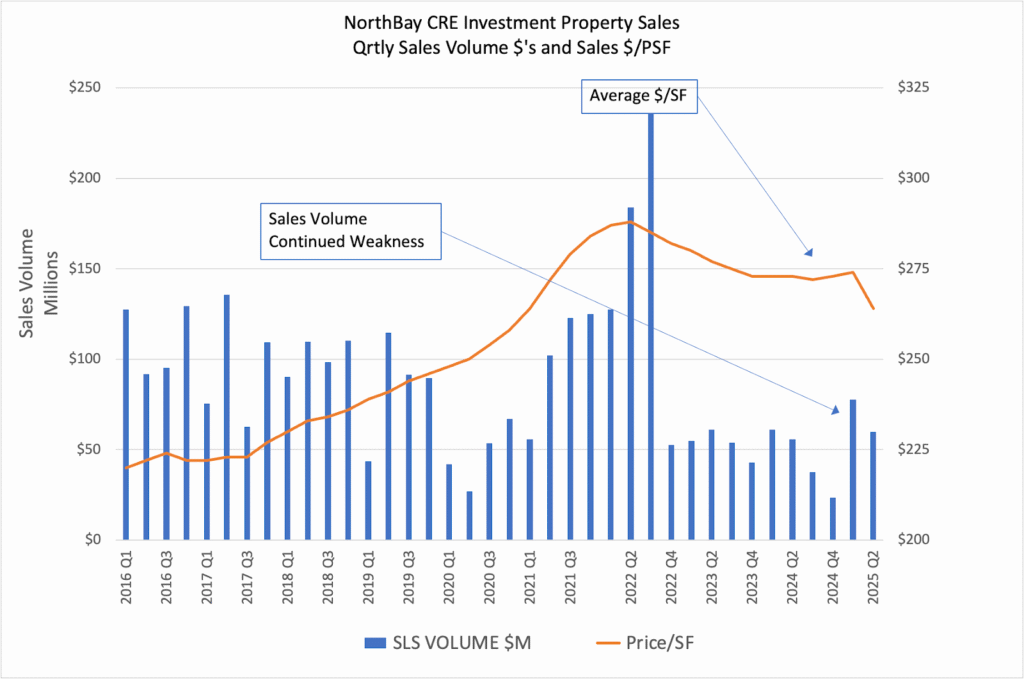

- Prices eased 3.3% while cap rates rose 13 bpts over 12 months—setting the stage for stronger yields.

- Inventory: 202 medium-size assets on market (10-yr avg = 139) → best selection in a decade.

- Sector moves: Pricing Per Square Foot: Office -4.2%, Industrial -6.8%, Retail +0.6%.

- Capital: 10-Yr Treasury closed at 4.76%; Bay Area CPI +1.5% while National CPI jumps 2.7%.

- Sales volume is still 32% below norm, but momentum is building.

Capital Markets Pulse

Treasury swings between 4.4–5.1% kept lenders cautious, yet spreads are stabilizing. As inflation cools, the first incremental drop in borrowing costs could unlock sidelined capital—particularly 1031 exchange buyers seeking yield.

Supply-Demand Balance

Sellers are back after recalibrating pricing, but distress remains limited. Limited new construction and enduring population/wealth growth give the North Bay a structural floor many markets lack.

Dataset: 4,104 multi-tenant office, industrial & retail buildings (60.4 M SF) across the North Bay.

Opportunity Playbook

-

- Window of Value – Today’s pricing reset offers above-trend yields without recession-level risk.

- Be Ready to Act – Well-underwritten deals move quickly once priced right; line up capital and due diligence now.

Looking Ahead (Next 90 Days)

- Rates: Fed watch shows bias toward a late-summer trim; expect incremental mortgage relief.

- Office: Continued price discovery; creative reuse discussions gaining traction.

- Retail & Industrial: Steady demand and limited supply support modest rent upticks.

- Transaction Pace: Anticipate post-Labor Day surge as investors seek Q4 closings.

HOW CAN I HELP YOU?

I’m a North Bay–based commercial real estate broker who helps property owners and investors unlock value in Commercial Real estate and Multifamily assets. From marketing and leasing to sales and 1031 exchanges, I combine market data with hands-on deal making to secure the right buyer, tenants, structure win-win transactions, and maximize long-term returns for my clients.

Curious how these shifts impact your portfolio—or a target acquisition? Let’s model the upside together.

Testimonial

“When we purchased 554 San Anselmo we weren’t sure if or when we would want to trade out of it. We stayed in touch with Ces, followed his newsletters and periodically spoke about how best to manage and add-value to the property, so when one day we decided to sell, the property would be ready. As a result, Ces found a great buyer and the sale was quick and smooth. We recommend Ces to anyone that is looking for an honest and straightforward experience when preparing their investment real estate for sale.”– David and Paige Hirshkop, Multi Property Owners