Properties in this report include all apartment buildings (5+ Units) located in the North Bay- 2,750 apartment buildings totaling 99,956 units. AVERAGE RENTS are market-wide , and your rents could be higher or lower depending on your buildings’ location and condition. You should be experiencing the same general trends in rents and vacancy as the market.

Want to know the true value of your apartment building in today’s market? Contact me for a personalized evaluation.

Key Insights for Property Owners and Investors

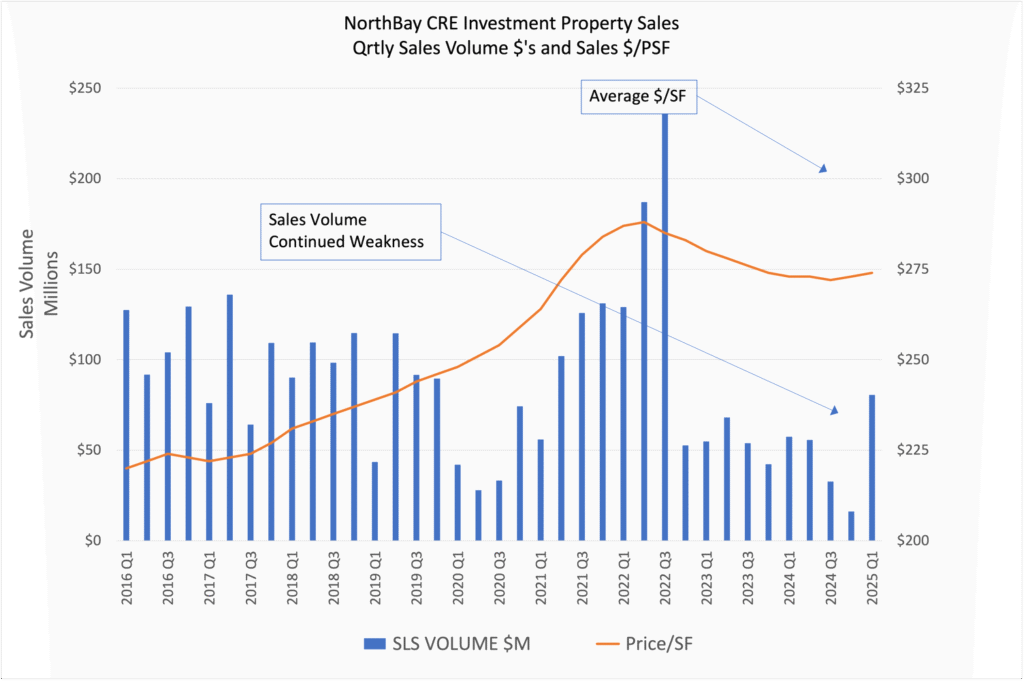

North Bay CRE pricing is stable (+0.37%) with rising cap rates (7.17%) and more inventory (180 buildings). Retail and industrial values are up; sales volume has increased and remains selective. Buyers are benefiting from greater choice and pricing resilience.

Pricing Trends

Overall pricing in the North Bay is relatively flat year-over-year (+0.37%). Nationally, small commercial properties gained 1.1% in value, while high-value assets fell 1.3% (CoStar CCRSI), a reflection of shifting occupancy dynamics. General commercial assets are gaining tenants; top-tier buildings are shedding them.

Sector-Specific Pricing Performance in the North Bay:

- Retail: up 1.93%

- Office: down 2.67%

- Industrial: up 0.85%

Average cap rates increased to 7.17%—a rise from 6.0% at the start of 2023—highlighting more cautious investor underwriting.

The 10-Year Treasury yield rose to 4.53%, up 9 basis points from last year, pushing up borrowing costs and shaping investor sentiment.

Sales are up 4x from last quarter, though still 9% below the 10-year average. Activity is returning, but selectivity remains high.

There are now 180 medium-sized buildings on the market—well above the 10-year average of 139.

This pricing stability—despite reduced transaction volume—highlights the North Bay’s niche market characteristics and gives investors greater selection.

Leasing Market Trends

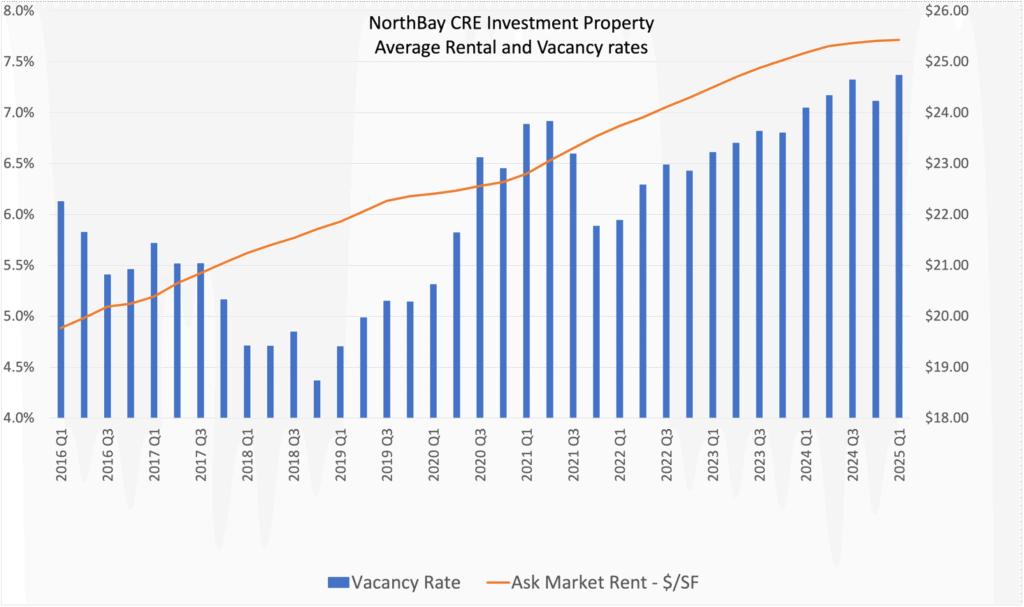

The leasing market showed modest but steady improvements in both absorption and vacancy rates.

Overall Vacancy: Rose slightly to 7.4% (from 7.2% last quarter)

- Office: 10.7%

- Industrial: 6.7%

- Retail: 5.3%

Rental Rates are Up 2.1% year-over-year, with prime properties driving tenant retention and rent growth. Absorption is cautiously positive across sectors, with demand strongest in retail and stable in industrial.

Key Insights for Landlords and Investors

- Retail Resilience: Retail continues to outperform, both in pricing and leasing demand—making it a stronghold for investment.

- Incentives Matter: In B and C class properties, competitive incentives and capital improvements are increasingly necessary to attract and retain tenants.

- Focus on Tenant Quality: The most important driver of long-term asset performance remains tenant quality. High-credit, long-term tenants are the foundation of value stability.

Positioning for What’s Next?

The North Bay is showing signs of resilience and recalibration. Whether you’re considering selling, refinancing, or repositioning an asset, now is the time to assess your portfolio and plan strategically.

Let’s talk if you’d like help benchmarking your property or preparing for your next move.

** Properties in this report include multi-tenant investment commercial properties – comprised of 4,104 MEDIUM size buildings totaling 60.4M square feet of office, industrial and retail located in the North Bay..

Testimonial

“Ces helped me identify a property that met my needs. He diligently uncovered hidden issues and expertly guided me through the process, working closely with me to address challenges as they arose. He is a great advocate and I highly recommend Ces to anyone looking to buy or sell investment real estate.”- Lisa Jackson, Property Investor